- Published on

How Index Funds Work

- Authors

- Name

- Jessie Jimenez

- @JessieDianeJim1

How can index funds help you win the investment race to wealth?

We'll get to this, but it's helpful to know how index funds work.

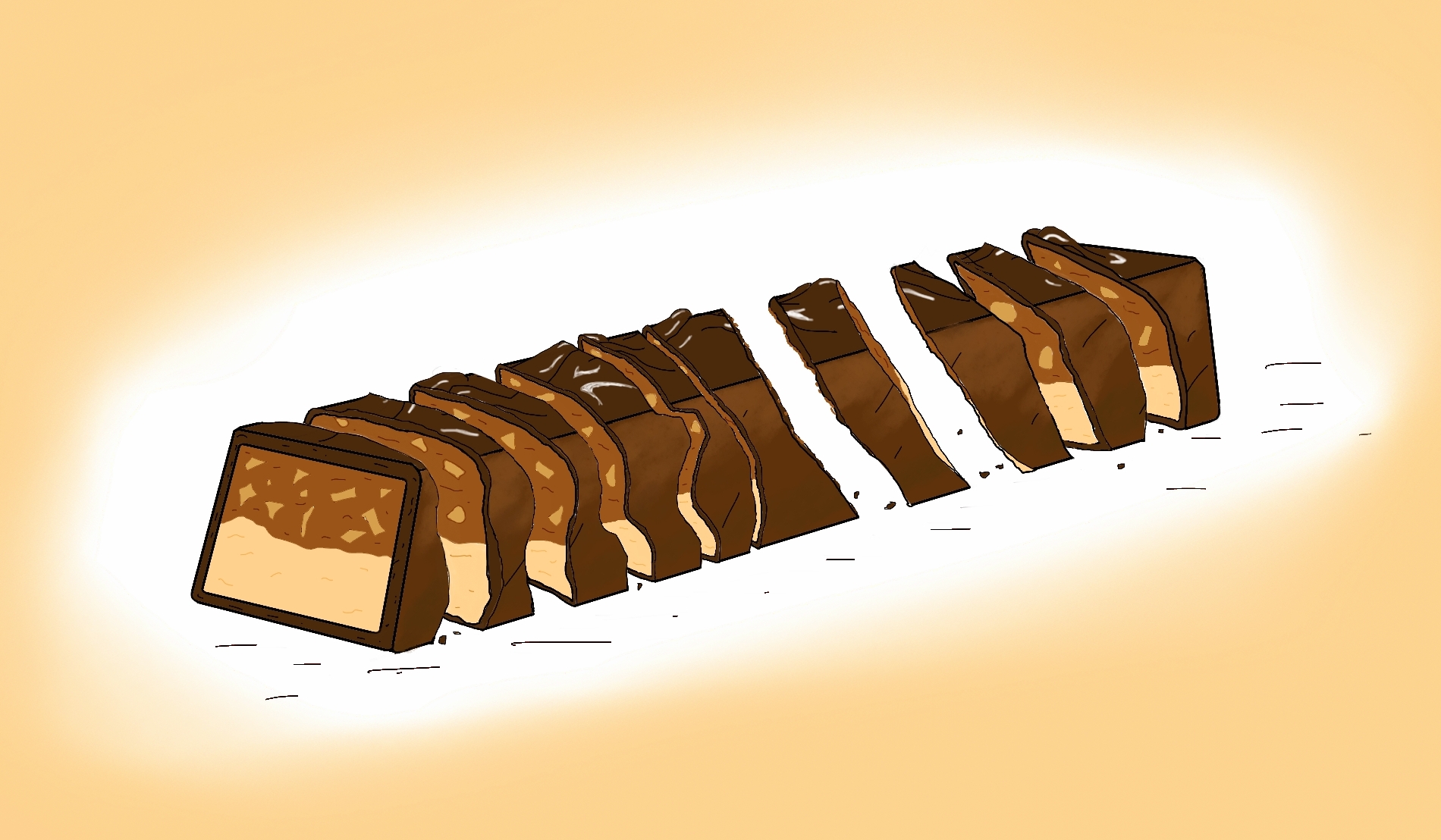

This type of investment wasn't always a choice. Imagine taking a trip to your corner store for something sweet. You pick your favorite candy bar and enjoy.

Ten bites later...

you've finished it.

Let's say that, instead of eating one kind of candy bar in ten bites, you want one bite of ten different candy bars.

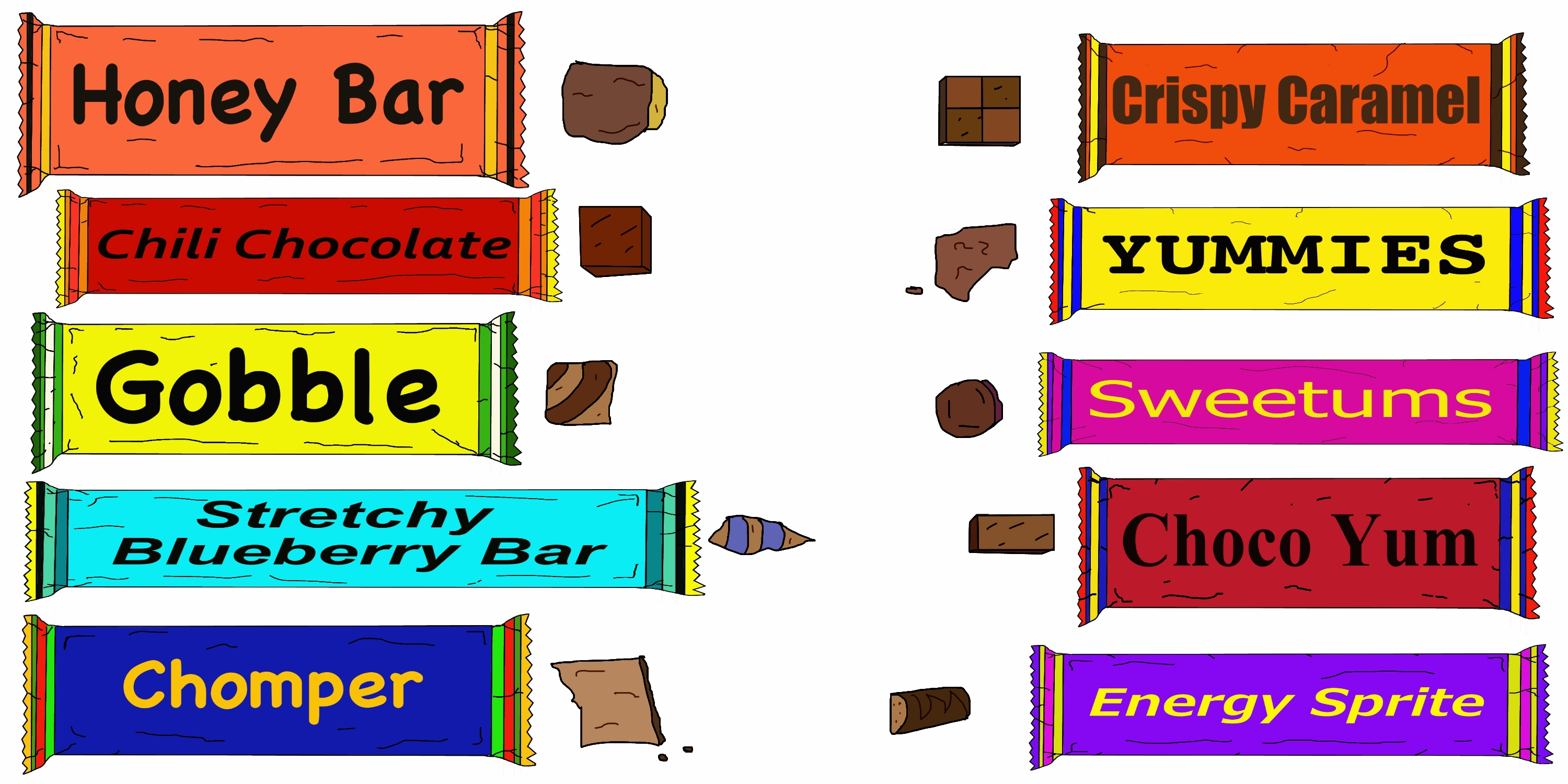

The cashier isn't going to be able to sell you just one bite of several snacks. Before 1976, buying stocks was a little like dealing with this cashier. You couldn't just get a little of everything until John Bogle started the first index fund.

This was like the stock version of the halloween variety pack! With the mini, fun-size pieces of every candy bar. You could now buy 1 bite of many different sweets!

This bite-sized candy collection of stock changed the investing game forever! Warren Buffett once said, “If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle.”

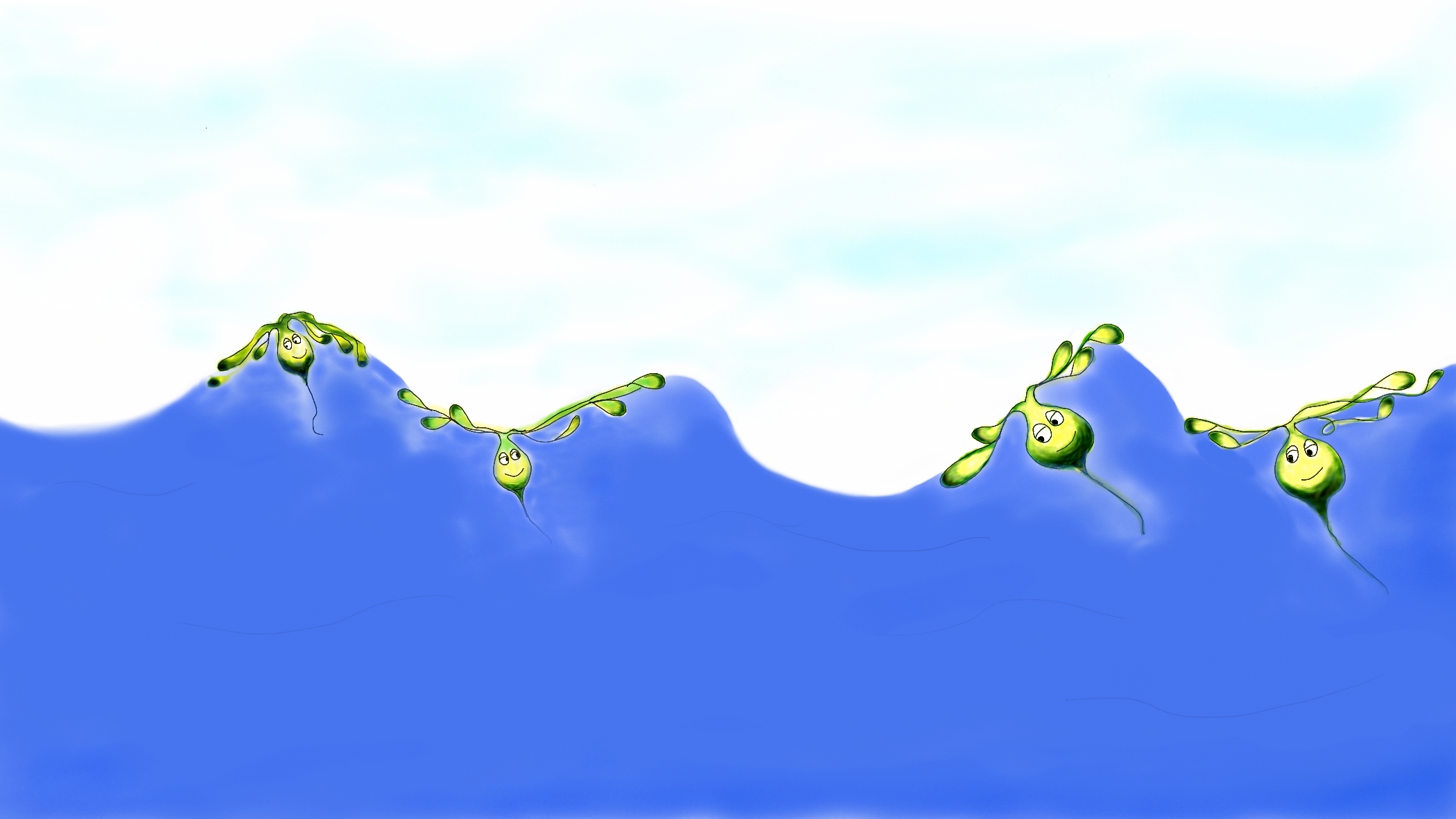

How can just going with the flow of the market make you money?

Even if you never fly above the waves?

Index Funds are supposed to do just average, meaning that you are in the middle of how everyone in the market is doing. Your variety pack of minis has all your favorites, but it also includes candies you don't like, because you have a bit of everything.

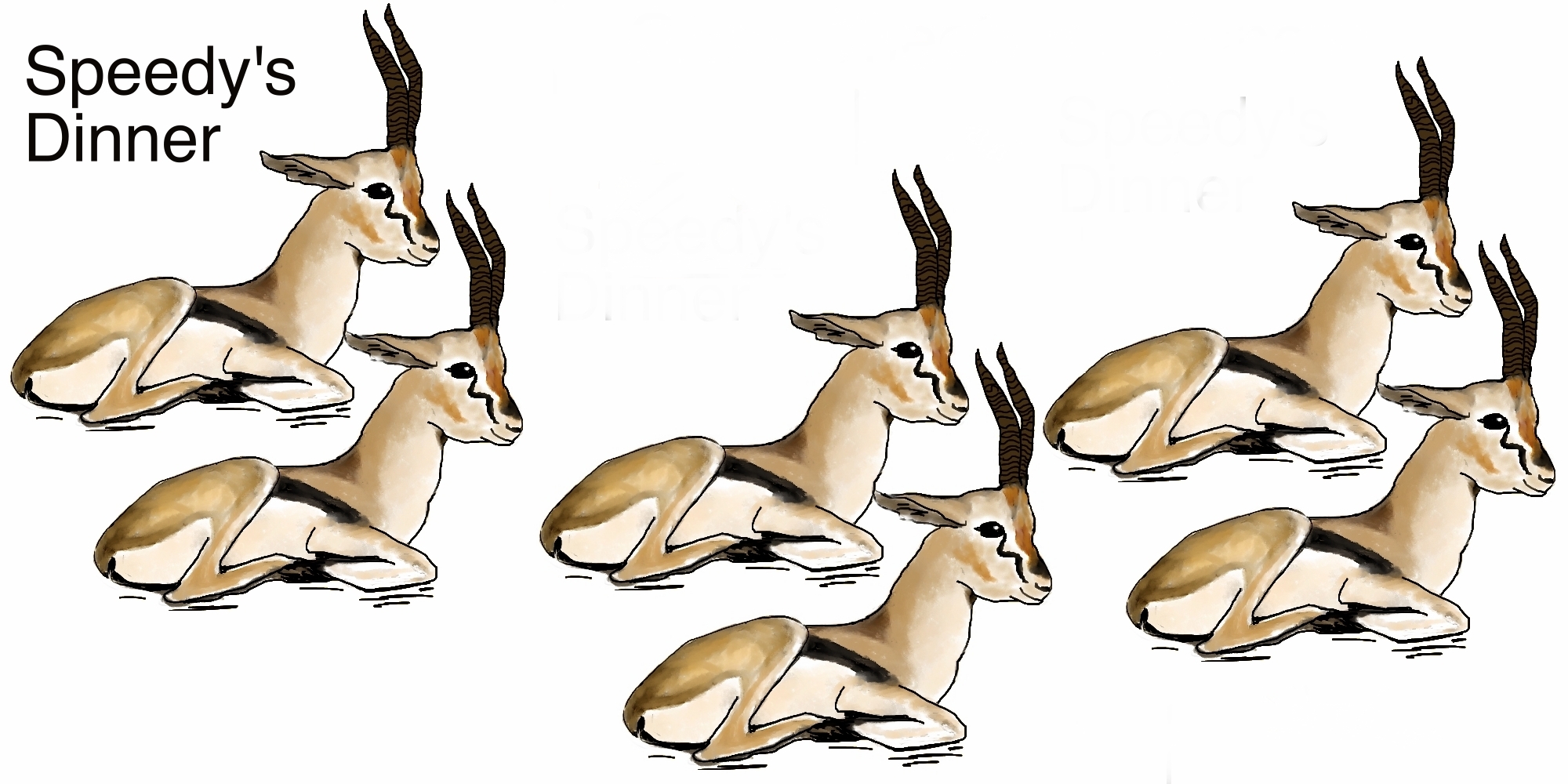

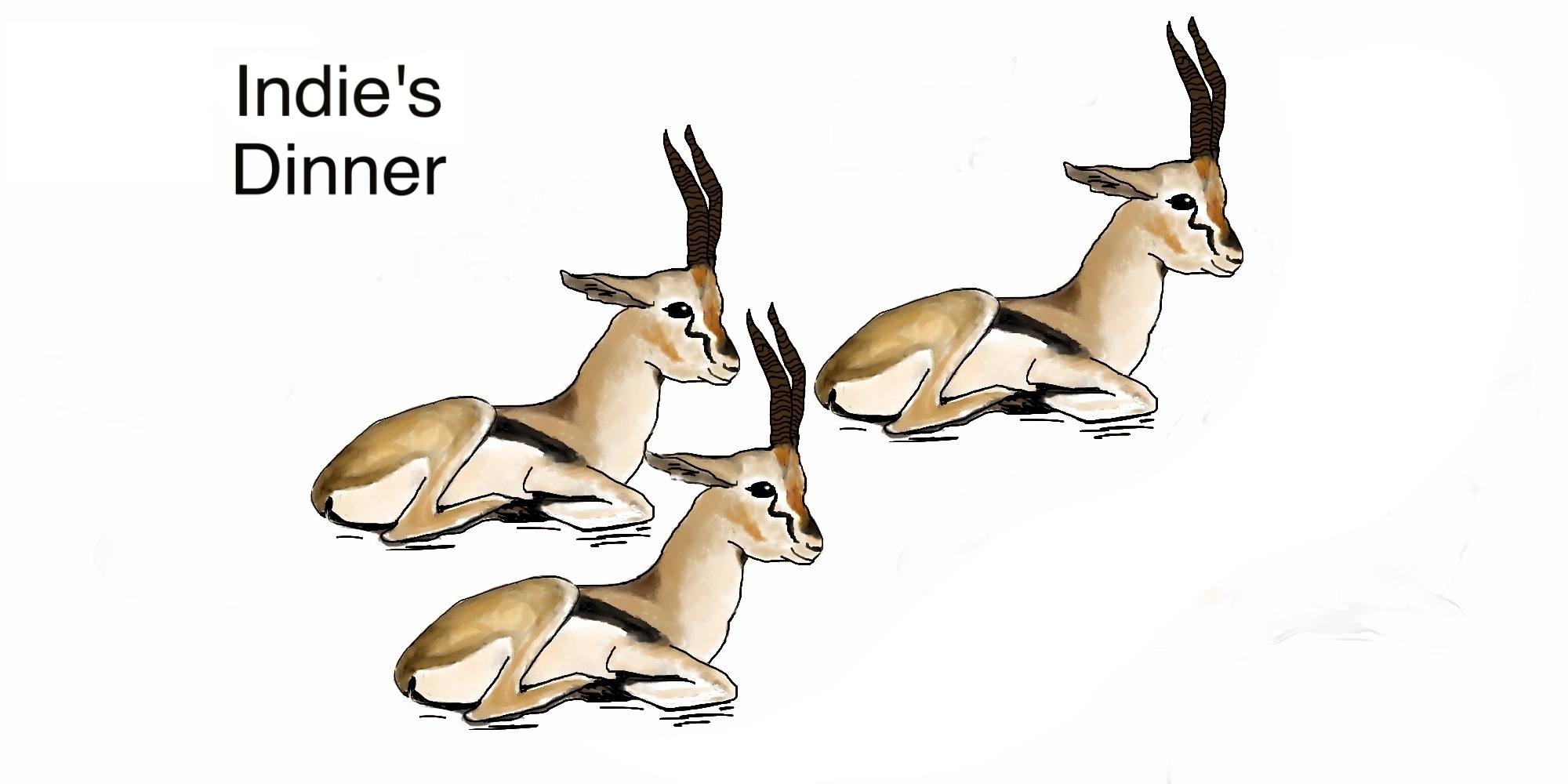

If your index fund were a cheetah, it would not be super-fit like, Speedy.

This time around, we'll say that Speedy can catch 6 gazelle per day.

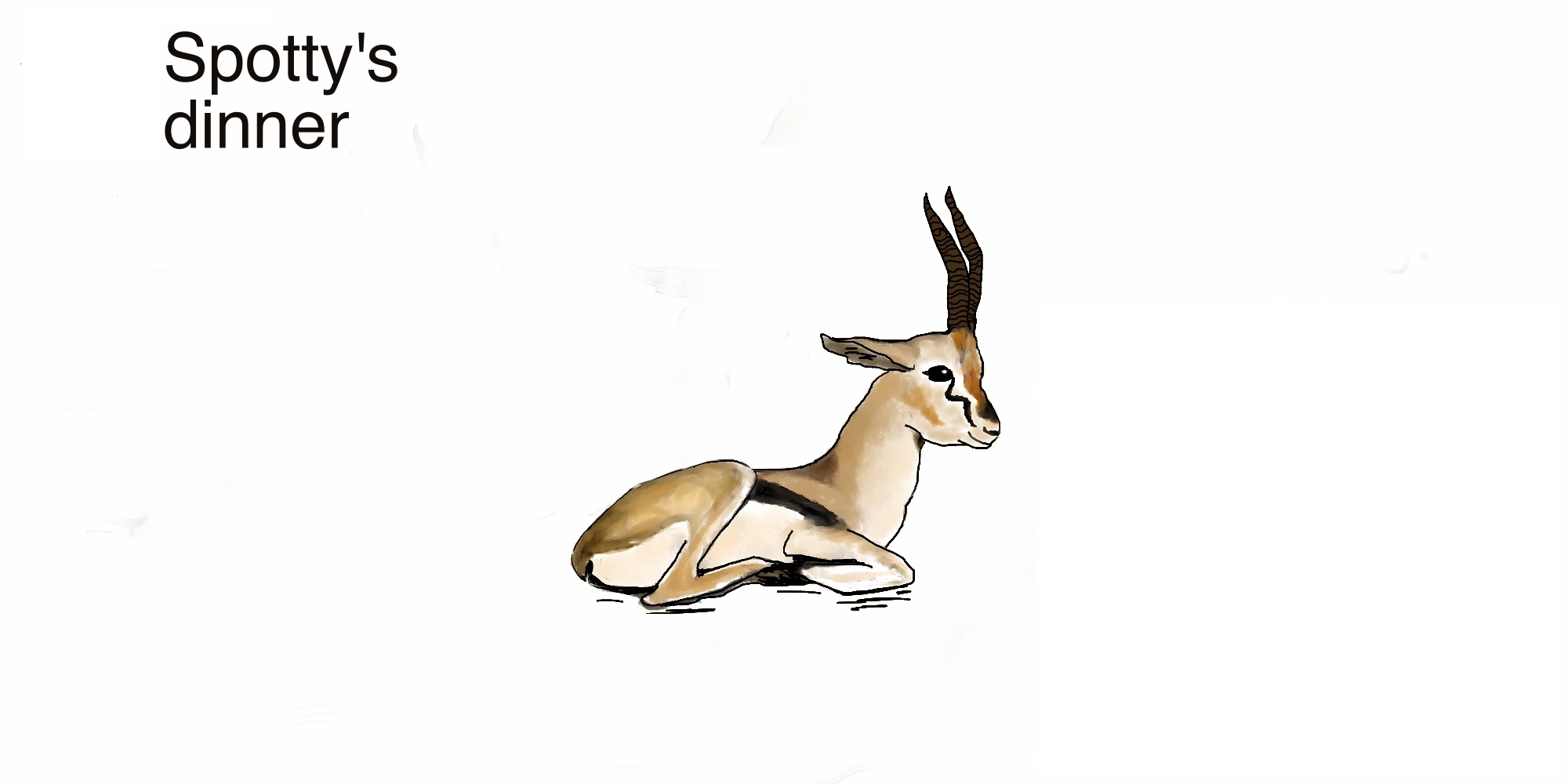

Spotty is now sharing the same savanna as Speedy.

But Spotty can only catch 1 gazelle per day.

Speedy is the best of the cheetahs on the savanna, and Spotty is the worst. If your index fund were a cheetah in this market, you would catch about 3 gazelle per day.

You're faster than Spotty, but not eating as well as Speedy.

How can you make money if you are never the best?

It turns out not many in the market are the best, and it is very hard to choose stocks that together will do better than the 3 gazelle a day you are getting.

It's helpful to remember that we see the market like we are tiny ants.

We only see right in front of or just behind us.

There you are in the red circle! If you could zoom out, you might notice that the market, as a whole, consistently goes up.

The catch? It happens slowly. If you smooth out the bumps, there is a gradual rise of about 7% to 10%.

The whole economy grows over time, slowly but steadily. You can make money by investing in this growth so long as you can ride out the downs, and you have the time.

Slow and steady wins the race!

The tortoise is slow but dependable, and a winner in the end. It's hard to argue with that.

Tune in early next week for a special tax day post of Cashtoons!

Sources

https://en.wikipedia.org/wiki/Warren_Buffett

https://www.getrichslowly.org/history-of-index-funds/#:~:text=On%2031%20December%201975%2C%20paperwork,public%20index%20fund%20was%20launched.

https://www.investopedia.com/ask/answers/042715/what-difference-between-speculation-and-gambling.asp#:~:text=Speculation%20and%20gambling%20are%20two,conditions%20of%20risk%20or%20uncertainty.&text=Gambling%20refers%20to%20wagering%20money,risk%20in%20an%20uncertain%20outcome.